Abstract

On November 3, 2016, the Central Bank of Egypt (CBE) announced the free flotation of the Egyptian pound in an attempt to stabilize the economy. Following this announcement, the CBE issued a series of press releases addressing the matter, and the flotation was widely covered by local media. This research content analyzes 605 articles from three websites (national, private, and partisan), along with the CBE press releases published from November 2016 until July 2017. It was found that the privately owned El Watan news website provided the most positive and optimistic views regarding the flotation of the pound, followed by state-owned Al Ahram and the partisanAl Wafd. The frames mentioned in the press releases of the CBE were reflected in the media coverage for these three news websites, however they were not constant, in terms of duration or longevity.

Introduction

On the 3rd of November 2016, the Central Bank of Egypt (CBE) announced the free flotation of the Egyptian pound in an attempt to stabilize the economy. The CBE had devalued the currency to 13 EGP per USD, a 46.3 percent decline from 8.88 EGP per USD. The flotation of the pound was one of the key demands of the International Monetary Fund (IMF) in order to approve a $12 billion loan to Egypt over three years. Between November and the time of writing, the Egyptian pound lost half of its value against the US dollar and the annual inflation rate rose above 30 percent. Before the devaluation, particularly in October 2016, business activities fell to their lowest level in the midst of a dollar scarcity. The budget deficit in Egypt was the highest in the Middle East, with a debt burden equivalent to its annual economic output (Adel, 2016).[1]

The devaluation of the Egyptian pound against the US dollar started an extensive debate across media outlets about the necessity and the potential of this decision, and different views were communicated through these venues. Different outlets varied in their portrayal, highlighting positive or negative aspects of the flotation, and delivering optimistic or pessimistic future insights of the flotation. From this emerged a vital question on the frames applied to communicate crucial monetary policy to the public through Egyptian news websites. This research focuses on examining how the CBE presented information about the flotation and investigates the role of news websites in communication between the government institution and the public. The article aims to describe how the CBE used the news websites as an intermediary in order to deliver their messages regarding the flotation of the Egyptian pound. It also provides insight into how these messages were framed and delivered online, through comparing the frames of the CBE with the media, and identifying consistent or divergent frames. It is hoped that this research will eventually help raise the awareness of the communication officers and media advisors of governmental institutions to be able to better communicate or provide clarification on new monetary decisions in a timely manner. It is particularly critical for stakeholders to be able to advocate for important policies that might be considered controversial or may not be well received.

Theoretical Framework

Since the primary focus of the research is to describe how Egyptian news websites portrayed the flotation of the Egyptian pound, the agenda setting and media framing theories offer the most appropriate theoretical frameworks for this research. Agenda setting and framing theory have been applied to identify trends in covering the decision and examine variation of the devaluation across these news websites.

Dearing & Rogers (1996)[2] define the agenda setting process as a continuous race between issue proponents, to grab the attention of media professionals, the public, and policy makers. Agenda setting provides clarification about why data relating to certain issues is being communicated to the public, how public opinion is shaped, and why certain issues are tackled by policymakers while others are not. The prominent role of agenda setting is better understood at the intersection of mass communication research and political science.

Policy can be directly affected by agenda setting as their interdependent relationship dictates that policy influences the media agenda and vice versa. Journalists demand access to the sources of news and policymakers are in need of coverage for their actions, yet the needs of policymakers and journalists are often incongruous because of their different consideration of time (Dearing & Rogers, 1996).

There are two levels of agenda setting that are essential to understand how the theory works. The first level relates to a transfer of salience for objects (i.e. public figures, institutions, or public issues) from the mass media’s coverage to the perception of the public. The second is about the transfer of salience for attributes to the perception of the public. At the first level of agenda setting, the effects focus on attention, where at the second level, the effects focus on comprehension (Carroll & McCombs, 2003).

The effect of the second level agenda setting on public comprehension can be described in terms of two dimensions. The first substantive dimension includes issue positions and ideology, experience, competency, or personal traits. These substantive attributes can be exhibited along a sentimental dimension defined as positive, negative, neutral, and mixed. The second, evaluative dimension, indicates the transfer of facts, tone, and feelings through news coverage (Carroll & McCombs, 2003).[3]

Second level agenda setting differs from ordinary agenda setting theory in analyzing the features or characteristics of several issues and individuals in news coverage, rather than focusing on the placement and the density of news coverage as traditional agenda setting does. For instance, the main hypothesis in traditional agenda setting theory is that the degree of focus on certain issues in news stories affects the public’s prioritization of these issues. Meanwhile, the hypothesis in the second agenda setting is that both the topics and features of these topics selected in the news stories contribute crucially to agenda setting acts.

Framing is considered a tactic applied by political actors to gather individuals around specific interpretations of issues or problems, or to advocate for new ideas. In the field of journalism, frames are the tools that journalists use to ease the processes of organizing and arranging huge amounts of data or information, compiling them in an effective way for their audiences (Chong & Druckman, 2007).[4]

Literature Review

According to Hester & Gibson (2003), both broadcast and print media often communicate negative rather than positive economic news to the public. Usually, increased coverage of economic news takes place during and after recessions and economic slowdowns. (Su, 2008)[5] Geiß, Weber & Quiring (2016)[6] found that the frames and messages used by the government relating to economy and industry were more powerful than other frames not developed by the government. Journalists adapt and develop their strategies according to the level of economic uncertainty.

Al Otiabi (2015)[7] argued that the volatility and speed with which economic events unfold reduces the amount of coverage because the facts and figures inevitably shift.

Zaki (2012)[8] reported that the ownership of Egyptian publications (national, partisan, private) was a major factor in determining the frames of economic reform issues in Egypt. She mentioned that national and private publications tend to use the same frames with minor variations. And that private publications are not independent. On the contrary, they tend to emulate national newspapers because of the corporate control of political and economic life, especially by those close to power.

According to Al-Nahas (2016),[9] high prices and increasing rate of poverty were the major economic topics that have been covered in Al-Wafd newspaper. The publication often calls for the improvement of the economic conditions to raise the standard of living for Egyptians. In their media coverage, they pointed out that peasants and workers are responsible for bringing social security and development, yet they are the most negatively affected social categories by the economic policies in Egypt.

Al-Sherif (2013)[10] mentioned that during economic crises businesspeople use economic news websites more than newspapers because of their instantaneous coverage, high interactivity, easy access, and rich information. However, during normal times, they prefer the treatment of economic print media for the more nuanced analysis.

Mahmoud (2016)[11] clarified that specific economic news, such as the stock market and investments, are focused on in coverage from Egyptian news websites. Meanwhile, the issues that affect the daily life of citizens, such as salaries, subsidies, and price, do not tend to have the same priority of coverage.

Doudaki et al. (2016)[12] stated that the dominance of institutional organizations on the news as frame-providers and sources was evident in the contradictions between the identified causes of the crisis, proposed solutions, and the fading appearance of crisis factors. The economic consequence frame is commonly used in news stories. This frame reports a topic in terms of the economic consequences it will have on a country, region, institution, group, or individual (Svensson et al., 2017).[13]

Newman (2013)[14] argued that framing does not alter the content of an issue covered, rather, it changes the weight given to said issue. Attribution frames, according to Newman, can also lessen the weight given, specifically the weight of economic considerations, which normally have a strong influence on the evaluation of a country’s leadership.

Kostadinova & Dimitrova (2012)[15] reported that the frequency of delivering human-interest frames in economic news is influenced by the theme of the economic news as well as the political environment. Human-interest framing is particularly notable in stories that communicate economic issues seen as controversial.

Mercille (2013)[16] found out that during Argentina’s economic crisis, the country benefited from examining the outcomes of previous experiences of currency devaluation, sovereign debt, and fiscal consolidation on economic growth. Nonetheless, European media outlets provided a distorted image of the economic recovery of Argentina and misrepresented the lessons learned from its economic reform decisions. This characterization resulted from these outlets focusing on the negative outcomes of the default, rather than presenting its advantages.

The reporting style adopted by media organizations, and how they frame news, is dependent upon the primary focus of the publication. Namely, whether it provides general news or is specialized in economic reporting (Kostadinova & Dimitrova, 2012).[17] The economic consequences frame proves its efficiency when the aim of the media coverage is to raise the economic knowledge and awareness of citizens (Radu& Ştefăniţă, 2012).[18]

Communicating Monetary Policy

Berger et al. (2011)[19] found that the critical monitoring role of the media tends to be more negative when inflation exceeds the target rate. This underlines the serious monitoring role of the media, even when the communication of (in the case of Berger et al.) the European Central Bank (ECB) is intense or the information content provided in ECB press conferences is thorough. They identified three factors influencing press coverage of monetary policy decisions: The policymaker, the general public’s preferences, and print media itself. They also found that more frequent communication from the ECB on monetary policy inclinations leads to a better public understanding of decision making and more favorable and extensive coverage. But reporting becomes less favorable if a decision is taken in an environment of relatively high inflation, particularly if unanticipated (Berger et al., 2011).

Many central banks have begun to develop communication strategies that are tailored for a broader audience, which has consequently increased recognition of these institutions. Communication can boost the effectiveness of a certain monetary policy by influencing public anticipation and behavior (Binder, 2017).[20]

Blinder et al. (2008)[21] stated that independent central banks must explain their policies and the reasons that underlie them. This will be translated as increased transparency and accountability on the part of the bank.

Without public outreach, policy does not succeed in stabilizing macroeconomic or promoting expectation-driven fluctuations. On the contrary, when the details of the policy process or even the determining variables of said policy are announced, stability is restored. Communication allows agents to build more accurate forecasts, stimulate greater stability in observed output, nominal interest rates, and inflation. Agents may have imperfect information regarding policy strategies. This highlights the important role of communication, as the perspectives of these agents may be inconsistent with policy objectives (Kumar et al., 2015).[22]

Bell (2005)[23] explained that the communication by the monetary policy committee at the Bank of England may be clear in sharing knowledge and asymmetric information, however this does not mean the elimination of economic surprises. There are several factors that influence the inability to simply express growth outlook, interest, and inflation rates, such as the complex nature of the issue itself, potential outcomes, uncertainties, and risks. Communicating new policy presents a challenge for the monetary policy committee.

Jenkins (2004)[24] pointed out that the challenges of communicating monetary policy such as conditionality and prediction can be addressed through adopting new technologies. For instance, the Bank of Canada developed a website that provides equal treatment of target audiences. Specifically, the website offers both specialized audiences and the general public releases, publications, speeches, technical information, information about the bank, and monetary policy. Jenkins argued that a clear statement of the target inflation will let consumers, investors, businesses, and financial market participants adjust their behavior, according to the belief that the expected inflation will be typically in line with the inflation target. Consequently, prices, wage, and financial market participants will be consistent with the target and then a stable macroeconomic atmosphere will prevail.

Lapp and Pearce (2012)[25] found that economic news affect asset prices and that the timing of the meetings of the US Federal Open Market Committee increases the impact of the news on the expected changes in the monetary policy.

Hüning (2017)[26] analyzed the effects of the press releases of the Swiss National Bank (SNB) on assets prices. His analysis covered different monetary policy news in press releases and press conferences following monetary policy decision. He found that the short-term expectations of the future path of the policy are determined by the announced inflation forecast.

Hughes et al. (2014)[27] highlight the importance of knowing and understanding which aspects of monetary policy news has an impact on the financial market expectations and asset prices, as this is essential when designing an optimal communication strategy for the central bank.

Velthuis (2015)[28] stated that what rendered the central banks’ interest for the media is drama, high stakes, and lack of predictability. He also clarified that business or financial reporters do not operate only as interpreters or observers but their role extends to be active participants.

Bennani (2015)[29] in his study found that coverage of monetary policy issues in European newspapers’ revealed the persistent heterogeneity between the members of the European Union on political and economic issues, and therefore on the several resulting policy preferences between European Central Bankers within the governing council of the European Central Bank.

Neuenkirch (2014)[30] argued that the more time that has passed since the last news coverage of information for the Central Bank, the more newswire coverage this information will receive. The Federal Reserve communications will receive less newswire coverage during the release of macroeconomic news, such as trade balance, employment report, and the ISM index, as coverage of other content will take priority in the news cycle.

Methodology

This descriptive analytical research aims to determine how the Central Bank of Egypt (CBE) communicated the devaluation of the Egyptian pound through its press releases to Egyptian news websites. It is hoped that the descriptive research here will contribute toward identifying and defining the frames used during the devaluation of the Egyptian pound in the press releases of the CBE as covered by three Egyptian news websites. Therefore, the independent variable in this research is the messages of the CBE as mentioned in their press releases and the dependent variable is the media coverage of the devaluation by the selected news websites.

Sampling

This research relies on purposive sampling, also called judgmental sampling. It is a nonrandom technique typically applied in qualitative research to detect and select “information-rich cases for the most proper utilization of available resources.” (Etikan et al., 2016)[31] To figure out how the new monetary policy was portrayed and its role in profiling the Egyptian economy, CBE press releases as well as news stories addressing the flotation from November 2016 till July 2017 have been examined from the three chosen news websites. This research focused on news websites rather than print media because of its instant media coverage, high interactivity, rich information, and easy accessibility (Al-Sherif, 2013). Similarly, Nguyen (2010) mentioned that news websites provide more news choices, diversity of viewpoints, and in-depth and background information. The selected news websites are online versions of three daily newspapers, and they represent different schools of journalism in Egypt (national, partisan, and private). Al-Ahram is the most widely circulating and oldest national newspaper, and according to Alexa, a global platform for analytical insights its news website has a higher ranking than other national outlets such as Gomhuria Online or Akhbarelyom Al Wafd newspaper. El Watan is a private daily newspaper that is ranked the third after the Youm 7 and Al Masry Al Youm according to Alexa, in an interview with media expert Ehab Sallam, Al Watan newspaper provides the most credible data and reliable media coverage.

Research Questions

Based on the literature review, the determinants of the applied theoretical framework, and the main research question “how the CBE communicated the flotation of the Egyptian pound via its press releases and how were these messages covered online,” a number of questions were derived. These were both in relation to the patterns of electronic news coverage by different news website, and the content of the press releases issued by the CBE. They are as follows:

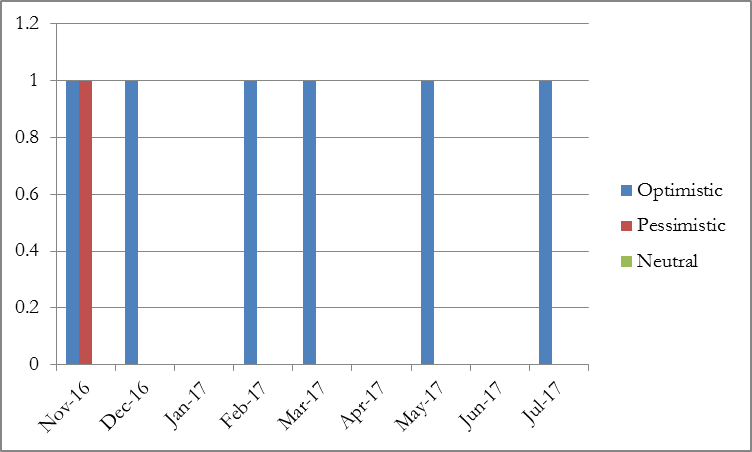

RQ1: What is the tone of coverage of the CBE’s messages relating to the flotation of the Egyptian pound on online news?

RQ2: What are the frames used in the press releases of the CBE and the news websites?

RQ3: What was the intensity of coverage on the news websites over the selected period?

Statistical Analysis

The Chi-Square (χ2) Test: χ2 is used to test the homogeneity of distribution of any two variables. We assume the null hypothesis that the 2 distributions are similar. χ2 will measure if the null hypothesis is supported by the data. χ2 is calculated as the summation of the squares of the differences between expected and observed values as a ratio of the expected value (Wimmer and Dominick, 2003). The significance of the resulting value of χ2 is measured by its probability parameter p at 0.05 or 0.01 levels of probability. If the p value is <0.05 or <0.01, the calculated value of χ2 is significant or highly significant and the distributions of A & B are different (not the same). If p is >0.05, the calculated value of χ2 is not significant and the distributions of A & B are similar.

Results

The first set of questions is directed toward identifying the type of coverage of CBE messages by online news websites, forecasting, and the sources used in covering different aspects of the decision to devalue the Egyptian pound against the US dollars. The second set of questions is directed toward exploring the media frames of the news websites and the communication frames of the CBE press releases, in addition to detecting the coverage intensity of the devaluation. The third set of questions aims to determine the impact of online coverage of the CBE messages by examining the journalistic styles that were used to cover the devaluation, the tone of the CBE press releases, and the CBE’s expectations toward the implementation of the flotation.

Based on the content analysis of 605 articles across the three news websites and six press releases issued by the CBE, five generic frames were identified. These include valence frames (positive/negative/neutral), risk/opportunity frames, as well as issue-specific frames that were related to the devaluation of the Egyptian pound. The sources, journalistic styles, and intensity of coverage were also examined.

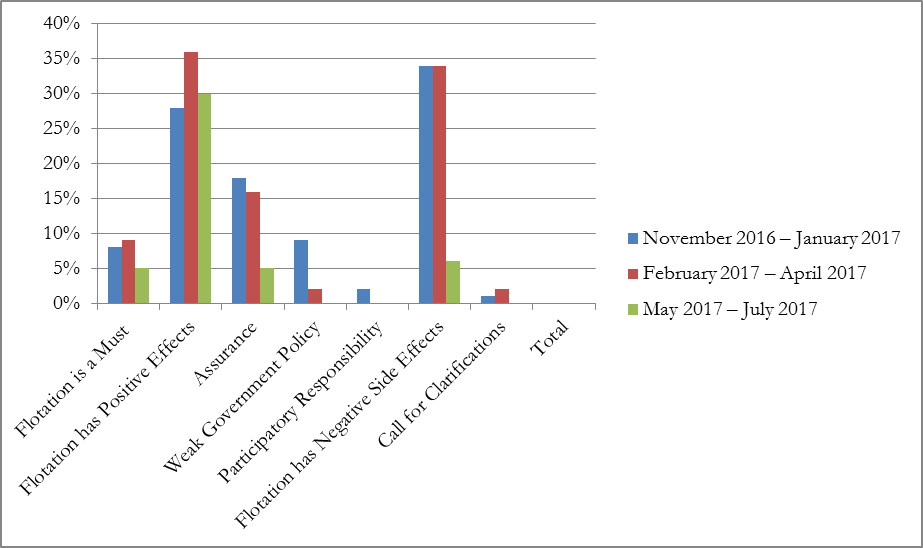

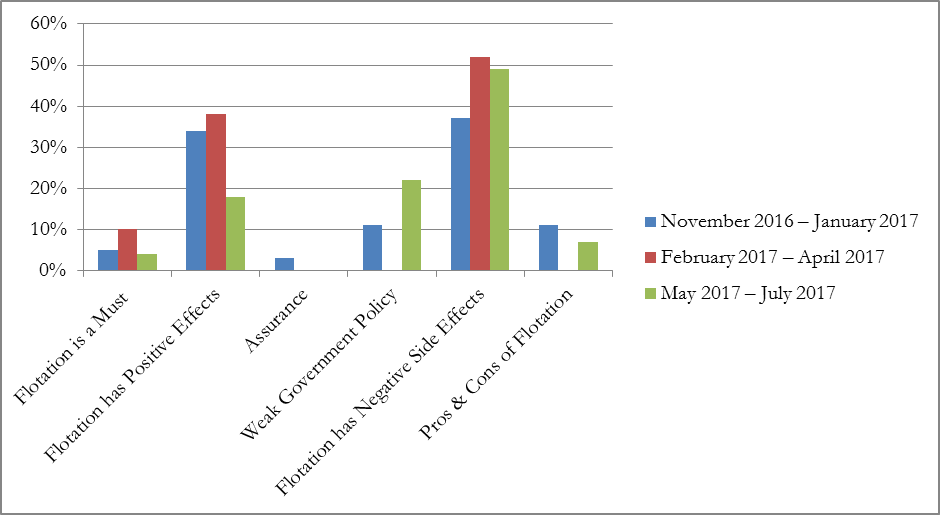

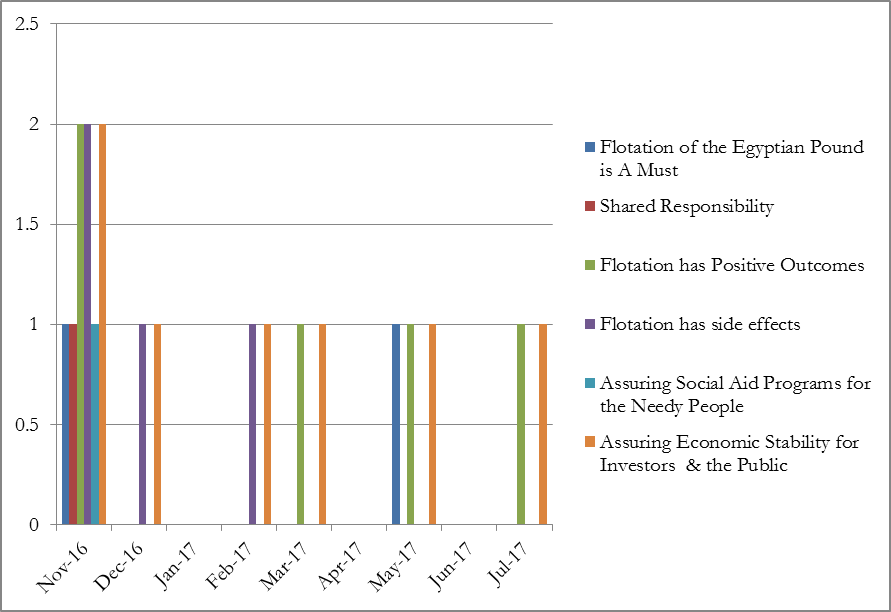

There were five media frames with sustained presence in the online coverage of the flotation as reported in the three news websites. They are:

- Flotation of the Egyptian pound is a must: This frame depicts the flotation as a necessity, that there was no alternative to stimulate the economy, eliminate the black market, and solve the problem of the foreign currency shortage.

- Flotation has positive effects: This frame highlights the expected positive outcomes of the flotation in increasing foreign reserves, foreign investment, Egyptian exports, and Egyptian stock market returns.

- Reassurance: This frame aims to reassure segments of the population that will be negatively affected by the flotation by announcing that social aid programs will continue to serve low income people. Investors and company owners engaged in the import of goods will continue to work with previous deposit and withdrawal limits.

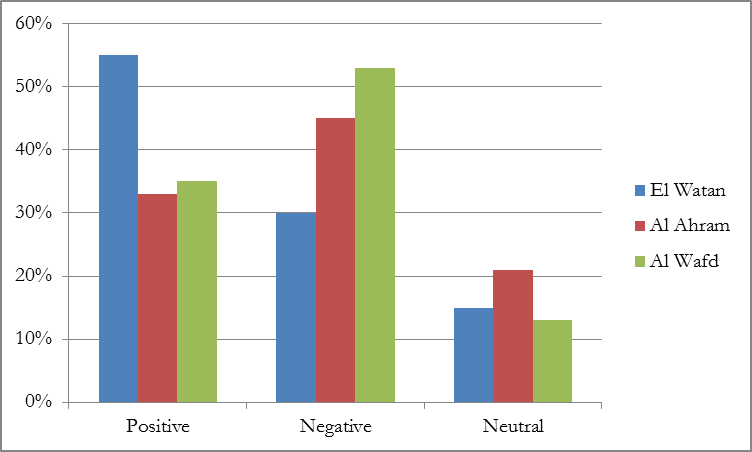

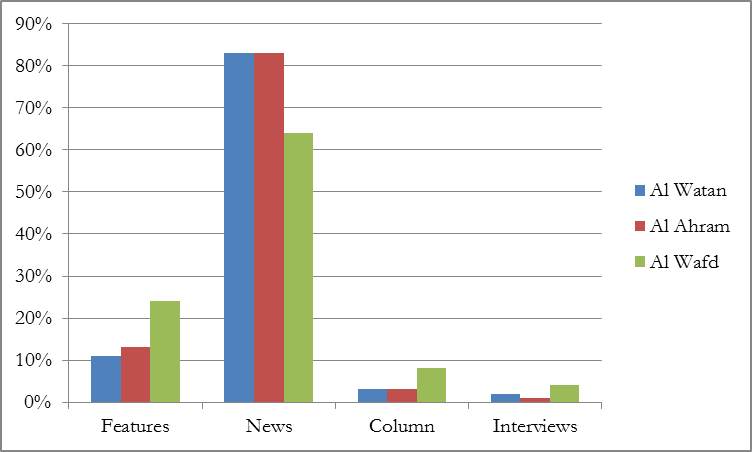

Figure 1: Tone of the Online Coverage of the flotation

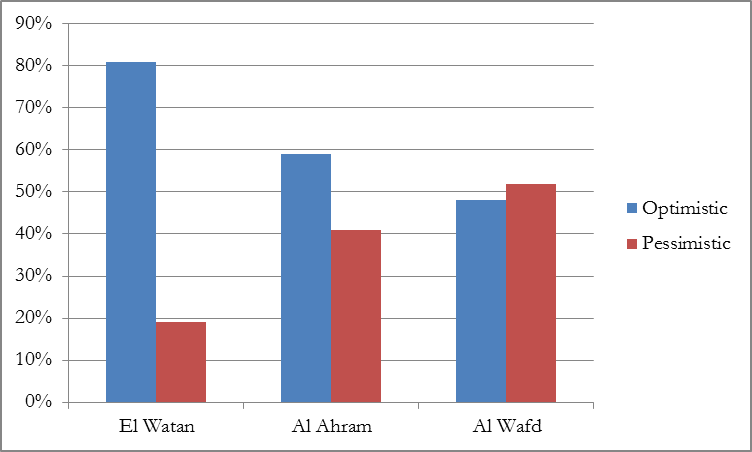

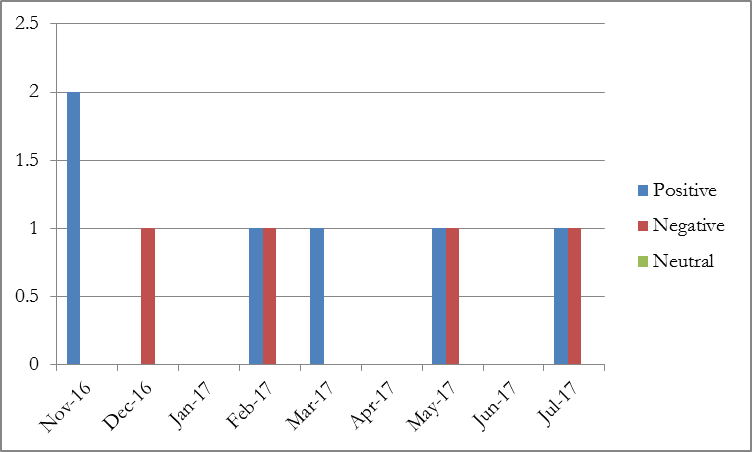

Figure 2: Future Insights on the flotation in News Websites

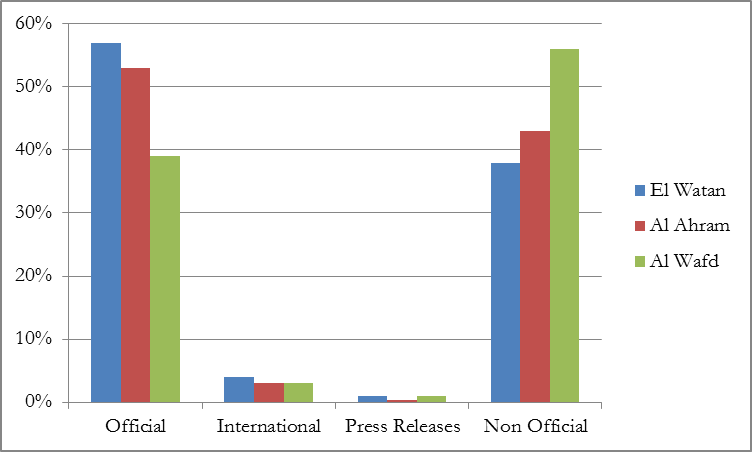

Figure 3: Sources of Online Coverage of Devaluation in News Websites

- Weak government policy: This frame focuses on contentious views of the flotation and its impact on the economy. Characterizing it as a sudden and surprising government decision that will fail in eliminating the foreign currency black and will result in price hikes.

- Side effects of flotation: This frame focuses on the negative side effects of the flotation. These include rising food prices, increased prices of imports, reduced availability of food supplies or manufacturing components, rising prices of healthcare supplies, and losses for both private and public companies.

Other media frames found in Al Wafd and El Watan included “pros & cons” of the flotation, compiling both potential positive and negative side effects. There are two other frames that appeared in both Al Ahram and El Watan. The first is “Participatory Responsibility”, a frame that reiterates government calls for acceptance a unified response from the public. The second is “Call for clarifications or strict management”, this frame documents the demands of different experts, notable figures, and the public to highlight the potential consequences of the flotation and call for managing the new monetary decision effectively to avoid losses. Another frame that appeared only in El Watan was “Evaluation of the flotation,” this frame aimed to explain the progress and the drawbacks of the flotation of the Egyptian pound post implementation.

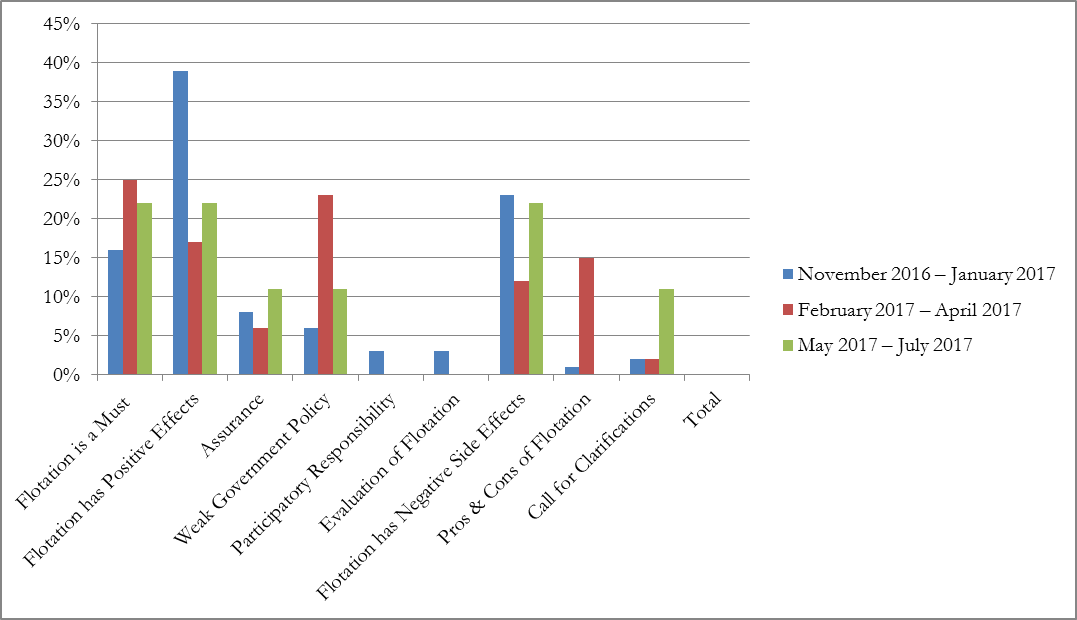

Figure 6: Media Frames of El Watan News Website

Figure 8: Types of articles used to cover the Flotation

Figure 10: CBE Expectations of the flotation as reflected in the press releases

Findings

In this research, the specific and generic frames of the flotation as they appear on the selected news websites have been investigated along with analysis of the messages of the CBE delivered through its press releases. This analysis has been done with the aim of identifying the frames used by the CBE to advocate for the flotation and analyze how these frames were reflected in online coverage. The assumption that national news websites provided more favorable coverage of the CBE’s messages was not supported by the data as the positive coverage of the flotation by private news website El-Watan (55%) exceeded that of the national news website Al Ahram (33%). Also, El-Watan provided more optimistic views on the flotation (81%) than Al Ahram (59%).

With respect to the frames used, the data indicates that the dominant frame used by Al Ahram was the “flotation has positive effects”. This accounted for the largest percentage for the publication at 36% of coverage. The negative frame accounted for 46% of the online coverage in Al Wafd. While the “Flotation has positive effects” frame accounted for 33% of the online coverage of El Watan news website. This was the most commonly occurring frame, classified among the positive frames that appeared in the online coverage. Therefore, the national publication focused on positive frames more than the partisan news website, but less than the private news website.

For intensity of coverage by national news websites as compared to private and partisan, Al Ahram was ranked first in terms of the number of articles allocated to flotation coverage with 240 articles, followed by El Watan with 238, while Al Wafd published 127 articles on the flotation.

Discussion

In an attempt to understand how messages from the CBE are reflected on Egyptian news websites, this research analyzed both press releases issued by the bank and the online coverage of the decision to devalue the Egyptian pound against the US dollar. From November 2016, the CBE influenced the agenda of media outlets by issuing press releases on the free flotation of the Egyptian pound. Media coverage of the flotation was intense, with hundreds of articles dedicated to the topic. The results of the research indicated a strong influence of the policy agenda on the media agenda of the selected news websites in terms of the space allocated for discussion, news of the monetary decision, and intensity of the coverage, which was at its peak during the first months of implementation with subsequent coverage of outcomes and impact. Irrespective of the variation in quantity of relevant articles by each website, the CBE set the agenda by releasing information that was then used by media outlets, increasing the online coverage of the devaluation.

Through its press releases the CBE communicated data for inflation, interest rates, and outcomes of the new economic reform measures. This information was primarily presented in a positive and optimistic tone. The research above supports the notion that these frames were transferred to the online coverage of the flotation in news websites through publishing the official narrative, quoting public officials, interviewing the governor of the CBE, and sourcing experts who supported the government decision. Nonetheless, the examined news websites developed other frames based on information from non-official sources. These frames questioned the sudden and significant decision or addressed potential negative side effects. Therefore, while the CBE influenced the media narrative, it did not have full control over the frames presented, nor entirely shape the agenda of the flotation in Egyptian media.

With regard to the frame building process, the framing of the flotation of the Egyptian pound was influenced by the ideology of the news organization and frame sponsors. This was particularly true in the case of Al Wafd, which published content in clear opposition of the policy decision. Overall, the framing of the flotation by Al Wafd was negative and pessimistic, while both El Watan and Al Ahram tended toward more positive and optimistic coverage.

The case of the flotation of the Egyptian pound, analysis of the generic frames (positive, negative, neutral) of media coverage could easily be replicated in another context. Equally, the examination of specific frames could hold value in other instances as well, as De Vreese (2005)[32] argued. For instance, the urgency of policy implementation, the pros and cons of currency flotation, and side effects, as well as calls for more information and further clarification on the devaluation, calls for strict management of the flotation, and the dependency of economic reform on the flotation are all issue specific frames that could be employed in other contexts.

Some frames referenced in the literature review appeared in the frames employed by both the CBE and the news websites, such as the opportunity frame; which focuses on positive forecasting; for example, increasing the foreign reserves and eliminating the black market, and the risk frame; which highlights potential negative consequences such as price hikes. However, as Chong & Druckman pointed out, frames that are consistent with a specific value cannot be applied to every situation or topic. For example, the conflict frame appears in negative reporting about the devaluation, most notably when investors, manufacturers, and traders expressed concern about the negative side effects of the flotation, such as high prices of raw materials, food, or healthcare supplies.

Not surprisingly, the economic consequences frame was apparent in all coverage. The economic impacts of the flotation on the community and individual Egyptians were discussed in detail. The human interest frame was present in the features that included emotional angles, describing how individual households reacted to the decision and in coverage that highlighted government initiatives to mitigate the negative side effects of the flotation on low income families.

The attribution of the responsibility frame, which emphasizes the accountability of certain actors did not appear in the online coverage, however in some cases the government was criticized for its sudden decision. Another form of the responsibility frame, namely the participatory or shared responsibility frame, appeared in both the press releases of the CBE and the online coverage of news websites in calls for the acceptance of the new economic reform measure and for Egyptians to contribute to stimulating the economy.

Politicians or policy makers can use the same communication frames adopted by other public figures, citizens, or the media channels (Edwards & Wood 1999)[33]. Ministers in Egypt and public officials used the same frames when they were quoted in news articles in the studied news websites. These frames portrayed both the opportunistic and positive aspects of the flotation. Meanwhile, when negative consequences were mentioned, public officials used the same frame of “negative side effects” and there was emphasis on the “reassurance” frame by mentioning that the side effects of the flotation would be controlled.

The online coverage of the flotation of the Egyptian pound tended to be positive in El Watan, less negative in Al Ahram, and more negative in Al Wafd news website. Thus, the negative tone did exist in covering the flotation, in citing controversial views on its instant effects and its future insights. This result conforms to the result of Hester & Gibson (2003),[34] who found reporters prefer to include negative angles or consequences. Nevertheless, the negative angles in the news articles of the flotation emerged from real facts and observations of high prices of commodities and goods in different sectors; they were neither opinions nor speculations.

As mentioned above, news coverage of economic events usually increases during and after recessions and economic slowdowns (Su 2008)[35]. The coverage intensity of the flotation was at its peak in November 2016, the month the CBE introduced the devaluation of the Egyptian currency as part of the economic reform measures in all news websites under study. January and February 2017 were in second place in terms of coverage intensity with December in third place. Coverage intensity started to fall from March to July, the end of the time frame of this research.

As Su (2008) [36] argued, the media agenda may be influenced by the audience agenda. This was quite apparent in the diversified online coverage of the impact of flotation on different aspects of life in Egypt. The concerns of different audiences such as the increasing prices of food supplies, medical supplies, ready-made garments along with the increase in the tuition fees, were addressed by the news websites. Furthermore, the unique media frames that appeared in the online coverage emerged from the different quoted sources, the different sectors tackled, and the specific events that took place following the flotation of the Egyptian pound.

In some cases, media outlets affect one other in terms of reporting the same content (Su, 2008). This is evidenced by the five frames that were consistent across the three news websites: Flotation of the Egyptian pound is a must, Flotation has Positive Effects, Reassurance, Weak Government Policy, and Negative Side Effects of Flotation.

The frames determined by Geib, Weber & Quiring (2016) in the coverage of the economic news appeared but in a different form related to the flotation. For instance, the “boost the economy” frame appeared in the positive effects frame. The “tame the economy” frame appeared in the necessity frame. The “let the government fix it” appeared in the reassurance frame that guarantees the government’s interventions to control the side effects of the flotation.

Entman (2004) explained that frames that are developed by the administration created the other frames that are adopted by elites, including members of government, media channels, and in the public sphere. However, this was not the case in Egypt. Some of the news articles documented the rejection of the flotation among parliament members, former ministers, and some economic experts. The other articles reflected the acceptance of the CBE’s decision.

There was an existence of competing frames rather than a dominating single frame (Gamson, 2005). Regardless of the negativity or positivity of the frame itself, there were several frames that exhibited the same idea. For instance, the urgency of the flotation was delivered in several frames such as “flotation is a must,” of “flotation is the only solution to solve the scarcity of foreign currency.” Similarly, the rejection of the flotation was delivered in different frames such as “the flotation is a weak government policy,” or “the flotation will not boost economic reform.”

The competition between frames in media coverage allowed the representation of alternative considerations, whether in the short- or long-term. It is beneficial to educate readers and even public officials about different angles of the issue in question. Some of the unique frames that were applied earlier in previous studies were present in the media coverage of the flotation but in different forms. For instance, the dependency frame used by Doudaki et al. (2016)[37] appeared in the frames “flotation is a must” and “flotation has positive consequences.” These frames translated the dependency of the Egyptian economy’s recovery, and the increase of the foreign reserves, on the devaluation of its currency. Another was the ambiguity frame of Svensson, Albæk, van Dalen, & de Vreese (2017)[38], that appeared in the “pros and cons” of devaluation, which explained the potential positive and negative features of the flotation. This frame mainly resulted from quoting sources including elites and non-elites, who had different views and speculations about the flotation.

Zaki (2012)[39] found that national and private publications tend to use the same frames overall, at times differentiating in minor ways. She concluded that private publications are not independent, but follow the same direction as national newspapers. This is due to corporate influence of political and economic life, especially by those close to power. The partisan publications, represented in Zaki by Al-Wafd and Al-Ahali heavily criticized government policies and the economic reform program, and called for the implementation of a liberal economic policy to boost production, investment, trade, free completion, prevention of monopoly, equity in income distribution, fair taxation, ease the burden of living for low income families, and the provision of basic services. The results of Zaki[40] (2012) reoccurred in this research, where the private news website El Watan and the national news website Al Ahram used the same media frames with minimal differences and El Watan overtook Al Ahram in providing an overall optimistic view on the flotation. Al Wafd provided the most negative and pessimistic views on the flotation through news stories and columns written by outsiders.

The majority of the online coverage of the flotation in the studied news websites did not submit a thorough explanation of the flotation, its implantation, and its consequences. This indicates that economic news websites in specific and newspapers in general continue to provide economic coverage that is inaccessible to a wider audience. Zaki (2012)[41] criticized the absence of explanation, further analysis for sophisticated economic terminologies in the media coverage of all Egyptian newspapers, and dealing with readers as if they already know and understand these complicated themes. Doaa Adel (2016)[42] pointed out that there were no illustrations or explanations provided by these websites when they covered specific topics such as economic reform programs, Egyptian pound price, IMF loan, stock market news, and Islamic banking instruments.

Berger et al. (2011)[43] found that the critical monitoring role of the media tends to be more negative when inflation exceeds the target rate, which underlines the serious monitoring role of the media, even when the communication of European Central Bank (ECB) is intense or the information content provided is thorough. The same scenario took place in the coverage of the flotation; it tends to be more negative, the percentage of the negative news articles increased in all news websites in the first few months followed the flotation, when the inflation rates were higher than in the latest two months, when the inflation rate witnessed a decline.

Daily newspapers which target a general audience have a greater tendency to pander to their audiences by personalizing their media coverage and engaging readers, or by focusing more on the human interest frames. This was the case in the coverage of Al-Watan, which provided features that tackle day-to-day issues, offering tips on how to overcome the negative consequences of the flotation. Much of the literature assumes that specialized media outlets tend to use thematic frames in the coverage of different topics. The episodic frame was the dominant frame of the media coverage of all other websites. Furthermore, the coverage of the studied news websites was dominated by the frame of the economic consequences; and this goes back mainly to the nature of the new policy or the government organization (in this case the CBE), which issued the decision of the devaluation. In non-specialized news websites, the economic consequences frame was mixed with other frames, such as the human interest frame (particularly by those covering healthcare, education, and social aid issues), the morality frame (in articles that covered the conditions of the unofficial (black) market), and the conflict frame (in articles that covered concerns of investors, importers, traders, and manufacturers on the devaluation).

Some of the studied news websites framed their media coverage negatively while including optimistic views for the devaluation. For instance, their reporting might focus specifically on the bad economic conditions inside Egypt, while indicating the flotation would have positive side effects. This was seen often in the coverage of both domestic and regional websites (not analyzed here).

Coverage by domestic news websites illustrates that the flotation of the Egyptian pound was the primary solution proposed by the CBE, not only to meet the requirement of the International Monetary Fund, but also to stimulate economic growth, eliminate the role of the black market of trading US dollars, and increase the foreign currency reserves. This was apparent by the weight given to the terms “flotation” or “devaluation”, which was greater than that given to the “gradual reduction of subsidies”, for example, which was another requirement of the $12 billion loan from the IMF.

The impact of the devaluation on different aspects of life was reflected in the topics covered by the general domestic news websites, as they reported different news and features on the basic needs of life such as food, health, housing, education, and the business or investment sector as well. The sources of the media coverage ranged between official and unofficial, but with different degrees across the studied news websites. For instance, Al Wafd news website used more unofficial sources than the official ones.

In contrast with Dearing & Rogers (1996)[44], who found that the mass media agenda often have a direct impact on the policy agenda-setting process in addition to the indirect impact through the public agenda setting process, the Central Bank did not include nor address any media frames in its press releases. The CBE press releases in the 3rd and 4th quarters of 2017 were not influenced by the online coverage despite having been thoroughly covered on news websites in the months prior following the implementation of the flotation.

Conclusions

This research aimed to study how the Central Bank of Egypt (CBE) communicated its new monetary decision to the public and how news websites of different types (national, partisan, and private) covered these messages. A content analysis was undertaken for both the six press releases of the Central Bank and the 605 articles in three news websites representing national, partisan, and private media for 9 months from November 2016 to July 2017.

The decision to devalue the Egyptian pound against the US dollars did set the agenda of the news websites for the examined period. Each news website published between 2 and 5 news articles per day; this coverage included quotes from public officials and experts who commented on the flotation that aired on TV channels. Thus, the policy agenda of the CBE influenced the media agenda of the news websites by directing their attention towards the devaluation. During this period there was another critical government announcement: The increase of fuel prices the day following the announcement of the devaluation. Coverage of this, however, was substantially less than that of the flotation. The intensive coverage of the devaluation in news websites can be explained in terms of its critical nature, with both positive and negative effects. This monetary decision does not affect few segments of society. On the contrary, it has a massive impact on households, companies, government organizations, and the nation as a whole.

Although the CBE did transfer the salience of the flotation to the media agenda of news websites, it did not fully control the attributes of the flotation on the media agenda as well. Through its press releases, the CBE communicated two generic frames (positive and opportunistic frames of the flotation) and 6 issue specific frames to the media agenda, yet there were other competing media frames. These media frames were developed to deliver the views of opponents or criticism of experts who disagree with the government decision to devalue the Egyptian pound, and to highlight the struggle of Egyptians when coping with higher prices.

Albeit limited, the negative or risk frames that promoted the uncertainty, ambiguity, and uselessness of the new monetary decision appeared in the online coverage, as a result of the sudden timing of the implementation of this decision. Some news stories criticized the surprising or sudden feature of the new government decision, as it was not communicated gradually to the public. Also, the reliance on unofficial sources such as experts, households, and businessmen in developing the news stories, supported the existence of these frames, especially in relation to calls for more elaboration and clarification on how its implementation would affect everyday life.

The language used by the CBE, and the real indicators that were repeated in all press releases, likely contributed to news websites not consistently including the frames of the CBE in their coverage. Therefore, the CBE was not the only frames’ sponsor in the online coverage of the floatation; there were some controversial views on the flotation.

The ownership of the news website does not guarantee a specific tone of coverage. For instance, private news websites may refer to a certain tone whenever they start to build issue frames. So, a private news website will not necessarily have an independent direction from other national news websites or views counter to the government decisions.

El-Watan, the private news website, provided the highest positive and optimistic views on the flotation; it provided coverage that led the new monetary policy appear as a favorable policy. This was followed by Al Ahram, the national news website, and Al Wafd, the partisan news websites. El Watan and Al Ahram relied on more on official sources in their news coverage than unofficial sources. While El Wafd relied more on unofficial sources than official ones.

It was concluded that there are some factors that determine the frame building process, such as the updates in the economic or monetary policy, sources of the news/article, the target audience, and the type of the media outlet. In the case of the flotation of the Egyptian pound, the generic frames (positive, negative, neutral) of media coverage could be easily replicated in another context. Equally, the issue specific frames that De Vreese (2005)[45] claimed to be only limited to the issue under study, could be replicated as well. For instance, the urgency (or lack thereof) of the implementation of the flotation, the pros and cons of flotation, the side effects of the flotation, the call for more elaborations or clarifications on the devaluation of currency, the call for strict management of the flotation, the dependency of economic reform on the flotation, are all issue specific frames that could be employed to another contexts.

The communication frames of the new monetary policy identified in this research could be replicated in a different policy circumstance, or a new government decision. Any change will have side effects, the side effects of the policy can be controlled through effective communication and calls for the involvement of different stakeholders to reinforce the changes.

Recommendations

Based on the analysis and the results of this research, it is suggested for the Central Bank of Egypt (CBE) to adopt a gradual communication strategy when it intends to implement a new policy or a new monetary decision. As this will provide media outlets with enough time to communicate the new policy in a comprehensive way with all its dimensions, cover its potential impact on all sectors, address its side effects, and mobilize the community for policy change. Also, the gradual communication strategy will let households be more prepared for all the changes accompanying the policy change, rather than being shocked by its outcomes.

It is recommended for the CBE to keep its communication materials updated and available through its various communication channels, providing news reporters constant and instantaneous access to them.

It is preferable for the communication team at the CBE to work in line with media outlets in introducing new policies or policy changes to the public sphere. This could be done through using a non-technical language in its press releases, or providing more clarifications or justifications through graphs and illustrations, and organizing round table meetings or press conferences for journalists to answer questions related to the new policies. Furthermore, it would be beneficial for the CBE to be alert to what is communicated in media outlets and try to address it in its press releases.

Further Research

Future research should examine how the press coverage of the devaluation of the Egyptian currency changed across time, and how the communication methods or the awareness campaigns of the public officials changed as well. This will help in identifying the variations that could occur in the framing process of public policies in the media channels. Moreover, it would be beneficial if future research employs comparison between the media coverage of two countries that went through the currency devaluation process within the same period of time. For instance, a comparative study of the media coverage of the devaluation of currency in Egypt and Nigeria, this will enrich the literature of media coverage of monetary decisions.

Furthermore, future studies should focus on how the public perceive the free flotation of the Egyptian pound and how the flotation affected them in their daily lives, and if the individual frames differ from the frames of the government institutions or the media frames of the Egyptian pound devaluation. Through compiling public knowledge and media consumption habits, a clearer picture of how the flotation of the Egyptian pound frames impacted them could be achieved.

Arab Media & Society The Arab Media Hub

Arab Media & Society The Arab Media Hub