However, Tydeman's departure, although unconnected, came at the end of a disastrous summer for ART/ADD. The problems revolved around ART (Arab Radio and Television)'s exclusive rights to the complete FIFA World Cup soccer tournament that had cost the company a reported $80m to secure. ART's awareness-building campaign kicked in a few days ahead of the first matches and resulted in massive overload of the company's telephone system, with one insider admitting they were at one stage handling more than 10,000 calls a day. The problems didn't end there. "The back-office [organisation] was horrible. It was an unmitigated disaster, a total fiasco. It wasn't marketed properly, and they should have been selling the World Cup at least 6 months ahead of the event, not six days. All of a sudden the 'phones were ringing off the hook, and ART imploded. People were screaming for subs, threatening to kill people, rioting, government officials were calling [ART president Sheikh Saleh Kamel] directly."

However, it could all have been worth it if the approximate 80,000-90,000 who did get through and took out subscriptions stayed loyal to ART. In simple terms each of their subscriptions, typically $50/month, would have translated into an income (although not profit) of $54m in a full year. Had the bulk of those subscribers remained for a second year then ART was in profit. Unfortunately, around 90% cancelled.

That's not all. John Tydeman was enthusiastic about making ART a one-stop shop for everything televisual, adding a huge number of international channels, and even managed to persuade Star Select, a pay-bouquet previously carried on the Orbit platform, to switch from Orbit and join ART as part of Tydeman's multi-level 'Pehla' platform.

This deal was a good one, at least for Star Select, boosting their guaranteed payments from ART. It could also have been a good one for ART if only viewers had been able to organise their way through the complex labyrinth that is the ART/ADD subscription process. Indeed, with the possible permutations of the four mini-platforms on offer (Pehla, Al Awael, FirstNet, and Star Select), then, having to calculate the clusters of channels within each mini-platform (kids, kids & knowledge, family, sports, gold, etc), viewers were confused, local reports suggest, as to which bundles to take. Those same reports suggest that far from growing the Star Select subscribers, numbers have shrunk by some 75% since the switch from Orbit.

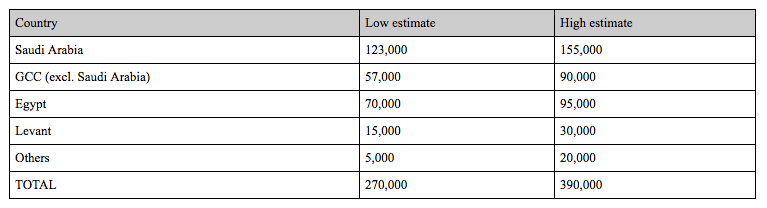

Few people comment on actual subscriber numbers for the competing pay platforms, although Tydeman did make a formal presentation to the influential International Advertising World Congress in Beirut earlier this summer. Tydeman admitted in his presentation that Middle East subscriber statistics are fraught with danger and generally not worth taking seriously. Indeed, in a study released in July by Screen Digest, the latter lists ADD's rival Orbit as having some 420,000 subscribers, a figure now wholly discredited. "We have taken an alternative viewpoint,"Tydeman told delegates, saying that ADD has employed what he described as an independent research group ("7 Degrees") to assess the size of the Arab digital TV market.

Tydeman said the six main Gulf-based Arab states have a combined population of some 27 million. Egypt and the other Mediterranean-based Arab states are extra to this number.Tydeman admits that he knows the actual subscriber numbers in his market, split between the three rival platforms of Showtime, Orbit, and his own ART-backed ADD platforms. He said, "If we release the actual numbers [they] would not be seen as being reliable," and by implication perhaps not trustworthy. He said the study looked at cable households by market and DTH (Direct-To-Home) homes by sub-region, and deliberately omitted hotels and public-place "viewing points."

Tydeman said ADD asked research outfit "7 Degrees" to talk to the hardware manufacturers, other suppliers, satellite dealers, and system installers, to give their own low/high estimates of the DTH situation in their local markets. In addition, Tydeman says the various cable-only markets there were some 92,000 households subscribing to one or more Orbit channels, some 81,000 homes subscribing to one or more Showtime channel, and 123,000 viewing ART/ADD channels. Tydeman stressed that there would be an obvious high overlap.

Although vague on specifics, Tydeman then added the three rival platform's totals and said "the figures come out at between almost 300,000 and 400,000 subscribing homes, and my own personal belief is that the [total] is somewhere about 350,000 thousand." Additionally, Tydeman said their 'middle of the road' assumptions were that Orbit had about 90,000 subscribers, Showtime ("although this is very generous and I think it's too high") had about 140,000 and that ART/ADD was the largest platform with somewhere in the vicinity of 150,000 to 180,000 homes subscribing via DTH. Add in cable subs, and the overall totals, that is DTH plus cable (with some considerable overlap), were:

Orbit 182,000

Showtime 221,000

ADD 303,000

Mid-East DTH*

*Data: ADD/"7 Degrees"

More than one conference delegate expressed some surprise at the figures and the way they were compiled. "ADD know their own, highly specific, figures. Why not issue those?" asked one highly placed local media observer. It seems a fair comment, and one has to ask why any broadcaster should fund what might be described as a wholly spurious exercise to 'prove' what the broadcaster already knows only too well.

Peter Einstein, president of Showtime, has subsequently disputed the figures, arguing that Tydeman's Beirut comments on Showtime's absolute subscriber numbers were "totally incorrect. His indicated range is closer to our DTH figures alone, without cable, MMDS, and other distribution. DTH is the strongest component."

However, Einstein also issued some good common sense about the Middle East's long quest for accurate subscriber data. "As far as numbers go, this business is not about being first. It is not important for us to compare ourselves with our rivals in terms of numbers. There's the all-important ARPU [average revenue per subscribing unit], or overall margin and the movement toward break-even and profits. Whether we accomplish leadership in subscriber numbers is almost immaterial, and whether we lead the pack or are at the last place in the pack is also unimportant. What my shareholders want is that movement into profits, and these are the measurements that matter, although it could be that we'll achieve some of the other milestones on the way. As for Showtime, and its target to break-even this winter (2002-2003), and certainly by 2002/2003 is that we are on target to achieve that goal."

The summer also saw another batch of free-to-air digital channels launched. Khalifa TV out of Algeria, Melody TV from Egypt, Dubai's Channel 33, TV5 Oriental from France, for example. More are promised with Egyptian, Beirut and Dubai entrepreneurs evidently desperate to climb aboard the television bandwagon. Einstein had a few words for these new TV stars: "Free to air [transmission] in the Middle East is bewildering. I don't altogether understand why people would want to put free-to-air channels up there that have little or no chance of ever making money. We all know that the advertising market in the Middle East is diabolical, and to slice that already small pie yet again, to take another ultra-thin slice of that pie, does nobody any good. I shake my head with bafflement. But many, many of these channels are there for a non-economic purpose, and if there is a non-economic purpose in their being available, then what can one say constructively? The whole premise of pay-TV is to supply them with programming and entertainment that they cannot get anywhere else. So, whatever someone may be putting out on Dubai Channel 33, even if it includes some English-language 'western' product, we know it will be old and people are always prepared to pay for something fresh and new and cannot be seen elsewhere. It is the normal pay vs. free market model that's existed all over the world. There will be an audience for free-to-air, but it will be older window material."

Meanwhile - and also speaking at the Beirut conference, and ahead of the launch of MBC's news channel - LBC's Pierre Daher not unreasonably complained that Middle East broadcasters are not getting anything like a fair return from the advertising community. "It is a very competitive market. Three years ago, if you would have asked me 'who in the Arab world would produce the Millionaire show,' I would have said nobody was able to produce a show [every week] to that exacting standard. It has happened. MBC ran it, with the same telephony model used in the West. It served them well for about three months but then the telephone income fell away. They have continued, which means that if your competitor is spending that much on programming and it is seen on screen as quality programming, then we have to react. It also means that prices for producing this sort of quality go up. We spent in 2001 compared to 2000 about 35% more in programme costs only. However, on the income side the whole market has not increased by more than 5%. Margins are tighter than ever. It cannot go on."

Daher said both LBC and MBC tried to hammer out some sort of merger deal, which he said remained his ideal, and "for the moment" is off the table. "We tried to create some sort of synergy together. It failed, although you will know of the so-called merger between MBC and Future which has taken its place. However, in my opinion this has done no good for the advertising industry. Had our merger taken place, between the Number 1 and Number 2 stations, it would have raised the total amount of income coming into the sector."

He added that if the newly merged entity meant more channels coming into the already-crowded market then he would react accordingly and promptly announced his own 'merger' plan. "It is an interesting situation. It is a different world we are going into. We are in discussions with the huge Al-Hayat newspaper group. They are more than discussions but less than a merger. The first thing we will inherit is their newsgathering abilities. The first step is to boost our own news coverage but it could also lead to a news channel if the financial state permits."

Associated Press TV News (APTN) is already a major supplier of news content to most of the Middle East broadcasters and it seems plenty of them are looking to tap into the high profile success (but not profits) being achieved by Al Jazeera. MBC has, within its all-embracing broadcast grid, won some high plaudits for news coverage. It seems Daher is contemplating some sort of rival operation to Al Jazeera and while APTN is keen to maintain its news supply into LBC, the local tie-up with Al Hayat might be the first piece of the complex jigsaw safely in place.

But he also urges caution. "MBC has a strong reputation in its news coverage. Al Jazeera has taken that ground, but we look at news somewhat differently. I look at news as another programme opportunity, like any other programme on the grid. Is there a place for another TV news channel? Today, you have MBC and LBC competing head-to-head. All that we are doing is recognising that one of our relative weaknesses is news, and we are taking steps to remedy that. Within the framework and the budget, which will grow because we have a partner and can pool our resources, there is definitely space to enhance news. But you might ask us if we were going to spend more on variety programming this year, and the answer would also be 'yes'. But is there space today for another 24-hour news channel? At the moment the answer is 'no'. Politically there's plenty to talk about, but financially it would be difficult."

On the vexed question of pay- vs. free-to-air, he admits there are challenges to both sides of the equation. "This is a very tough question. Will they join us in being free-to-air, or will we join them on their pay-TV platform? It is hard. The history of encrypted TV in the area is bad. Its reputation is bad." His dilemma, along with the other channels, is a shrinking income base. "We are reaching a point where it is quite likely that this year will be a peak year for pan-Arab [advertising income]. The peak in the Lebanon occurred in 1999. Since then income has gone down, about 10% per year and last year income fell more than 20%. This year we will be 25% down. By next year we could be 40% down on 1999. In terms of gross income the Lebanese station will be $20m, and on satellite about $48m. Commissions would see about 40%-45% of that removed before we see anything. It's nothing. TF1 almost spends more in a day than we do in a year!"

Besides the three or four key channels there are another 55 or more free-to-air channels beaming out from Arabsat and Nilesat, an increasing number transmitting only in digital. "They don't bother me. They have already been marginalized, and although they each take a percentage point or two away from us, the stations that are really hurting us are the foreign stations. HotBird is a reality, and some of their pornographic programming has a lot of appeal in this region."

Daher's message was clear: "You ask if pay-TV must merge. I say even free-to-air stations must merge to survive. We will have another year or so, losing a million or two each year. But after that there will have to be changes. It is simple: put your station on satellite and you multiply your losses ten-fold. Go onto pay-TV and you multiply them by 100!"

He talked about the Middle East's "miserable" slice of the world's TV ad-spend, which grew 7-fold between 1950 and 1996, culminating in an overall global ad-spend of some $429 billion last year. "The Middle East does not even reach $1 billion [across all ad sectors]. "I do not understand markets in terms of optimism or pessimism, but rather in terms of realism. The Middle East has the potential to be a major world player and the golden rule is liberalisation. What we need is on one side a lift of all government restrictions to allow the emergence of free privately owned media in all sectors, and on the other hand courageous investments in media. Such double action will revive the market, encourage investors, increase consumption and put the region on the global marketing map. With a population of over 300 million people, all speaking the same language in a highly strategic region of the world we have all the potential we need to compete with the rest of the world, and attract billions of dollars in advertising budgets. If we don't do it, someone else will, and instead of being the producers and creators, we will end up being part of the audience."

Asked whether he saw a threat from outside operators like Rupert Murdoch or Vivendi, his answer was straightforward: "We are not worth the bother."

Arab Media & Society The Arab Media Hub

Arab Media & Society The Arab Media Hub